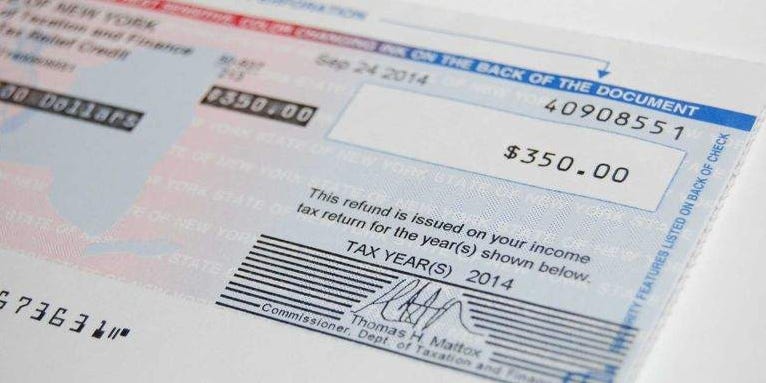

new york tax rebate check

The check goes to homeowners who are eligible for the usual STAR tax break and make less than 250000 a year. Photo of a 2022 Homeowner Tax Rebate Check received on June 3 by WSJ Reporter Jimmy Vielkind photo from Twitter.

|

| Ubgajrnbfov 0m |

Mrs Hochul is calling for this one-year program as an extension to the existing Property Tax Relief Credit Program which expired after 2019.

. However if you sold your home prior to the school tax due date you should return the check along with a brief note of explanation to this address. Seniors would also be eligible as would New York City homeowners. The one-year program was implemented by the state to give homeowners some property tax relief in 2022. The Good the Bad and the TBD Explore.

The homeowner tax rebate credit HTRC is a one-year program providing property tax relief to eligible homeowners just this year. To be eligible for the stimulus check from New York residents must earn less than 250000. Homeowners in New York State should start checking their mail for a homeowner tax rebate credit. Hochul and the New York state Legislature.

The property tax relief would be known as the Homeowner Tax Rebate Credit and would be provided to low- and middle-income families. The one-year program was initiated to provide property. 4 Ways Stimulus Payments Are Still Affecting the Economy in 2022 The rebate is part of a one-year program that will provide direct. 10 things to.

Under the STAR rebate program eligible homeowners get a break on their school taxes if they earn less than 500000 a year. With New Yorkers facing the costs of inflation in the supermarket and at the pump all while still enduring the economic impacts of COVID-19 Governor Hochul will provide much needed relief through a property tax rebate program that will return tax dollars to middle. That rebate was expected to arrive this fall when the Democratic governor is set to. Some New York homeowners will be getting a check from the state in the coming weeks in the form of a tax rebate credit.

Also residents who have been earning less than 75000 will be expected to receive an average stimulus check sum of 1050- as they will be considered as low-income homeowners. Qualified for a 2022 STAR credit or exemption. The rebate checks will be mailed to homeowners in the fall. About 3 million New Yorkers are eligible for a homeowner tax rebate that will be hitting mailboxes this month with checks totaling 100 or more per household.

Residents must be eligible for New Yorks School Tax Relief or STAR program in. If youre a homeowner in New York state check your mail. New York has begun mailing out this years homeowner tax rebate checks. Eligibility for the tax rebate is dependent on a number of variables.

The credit is available for low and. PROPERTY TAX CREDIT BUREAU HTRC WA. New York is set to spend 22 billion in one-time property tax rebates for low and middle-income homeowners. The credit will reduce the amount you can deduct on the property tax section.

NEWS10 The states budget is now providing 25 million eligible New Yorkers a property tax rebate. Deliver a 1 Billion Property Tax Rebate for More Than 2 Million New Yorkers. The average benefit in Upstate NY is 970. The state Department of Taxation and Finance has.

The checks were originally scheduled to roll out in the fall of 2022 but the state has decided to send them out early. Income less than or. By Dan Murphy As part of a NYS budget deal agreement reached in April about 25 million NY homeowners will receive a rebate check for the property taxes as part of the Homeowner Tax Rebate check program. Apr 11 2022 1046 PM EDT.

Property owners can visit the state. Tax cuts health care worker bonuses. More on NY tax creditsHochul wants to send 22 billion in property-tax rebate checks in fall of election year More on NYs budget proposal. The checks are part of a one-year 22 billion program included in the state budget in April.

More than 2 million homeowners will get a rebate on their school property taxes this fall as part of the new state budget approved Saturday. Rebate amounts vary but the average check for an eligible homeowner in Upstate New York is about 970 according to the state. New York To Issue Stimulus Check Payments. NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE ATTN.

Eligibility for the Homeowner Tax Rebate Credit. Also they need to be eligible for the states school property tax rebate program. HARRIMAN CAMPUS ALBANY NY 12227-0801. In order to be able to apply for the HTRC or the homeowner tax rebate credit one needs to be qualified for a 2022 School tax.

The Homeowner Tax Rebate check was sent with accreditation to Gov. About 3 million New Yorkers are eligible for a homeowner tax rebate that will be hitting mailboxes this month with checks totaling 100 or more per household. The state has begun mailing out the homeowner tax rebate credit. The program cost the state 22 billion.

|

| Ny Sends Tiny Checks To Pay Interest On Last Year S Tax Refund Syracuse Com |

|

| Ny Ended The Property Tax Relief Checks Why They May Not Come Back |

|

| Ny Homeowner Tax Rebate Checks Arriving Early Whec Com |

|

| Ny To Homeowners Your Tax Rebate Check Is Almost In The Mail Newyorkupstate Com |

|

| New York Property Owners Getting Rebate Checks Months Early |

Posting Komentar untuk "new york tax rebate check"